Contents

CMC Markets Plc is the ultimate parent company of the Filer. Certain types of CFDs, such as CFDs where the underlying instrument is a security, may be considered to be “securities” under the securities legislation of the Applicable Jurisdictions. Submit its audited financial statements within three months of the financial year end together with an annual return and reconciliation of the annual return to the audited financial statements.

Yes, Scotia iTRADE offers you TFSA and RRSP accounts. Registered account holders get the following choices. Scotia iTRADE requires clients to be 18 years or older when opening an account. If you want live market data in real-time, you’ll have to pay an additional fee.

While it is a bank, Scotia iTRADE doesn’t offer managed portfolios. Scotia Bank is one of Canada’s best discount brokers with access to affordable fee structures and commissions and award-winning trading platforms. It’s a great choice for new traders, offering educational resources to learn about trading. CMC UK is authorized and regulated by the United Kingdom Financial Conduct Authority in the United Kingdom. CMC UK is currently regulated as a full scope BIPRU investment firm by the FCA. CMC UK is licensed in the U.K., among other things, to act as principal to its clients in the products it offers and may deal with all categories of clients, including directly with retail clients.

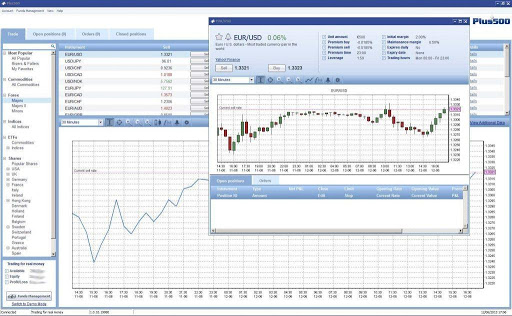

Furthermore, CMC UK is regulated on a consolidated basis in the UK by the FCA. CMC Markets allows leveraged trades through contracts for difference . With CFDs, you are not trading forex but speculating on the future movement of global markets through a range of products, including forex, stocks, indices, and commodities. They boast spreads as low as .30 points on gold and .70 points on EUR/USD.

Cumulative loss limits for each client’s account be established . As a member of IIROC, CMC Canada is only permitted to enter into CFDs pursuant to the rules and regulations of IIROC . Dow Jones expected to start cautiously higher on Friday as traders… The actual fact that the broker has joined the Financial Services Compensation Scheme ensures a decent deposit insurance. This implies that customer deposits up to a maximum of 50,000 British pounds are shielded from any losses that might arise, for instance , due to the broker’s bankruptcy. This is the Financial Conduct Authority , which is extremely strict in a global comparison.

Minor currency pairs often include major currencies traded against each other, excluding the US dollar. A couple of examples would be EUR/GBP and EUR/JPY. Please try again, or contact customer service at The listing of Porsche AG, under a trading code that includes the 911 number in a nod to its most famous model, defied turbulent markets to give the car brand a value north of 75 billion euros ($72.78 billion). Porsche AG shares rallied on their Frankfurt market debut on Thursday as traders dumped holdings of its controlling companies to grab a slice in the newly listed supercar manufacturer.

I have traded with CMC before and they often tend to close positions prematurely but WITH warning. I trade low volatility SPX which does not run the risk of strong multiple basis point moves. Just so happened the CMC closed my short without warning me to add cash or taper the position right before the crash . My take is that they do this on purpose after-all they make money on clients losing money.

Employees also rated CMC Markets 3.8 out of 5 for work life balance, 3.6 for culture and values and 3.5 for career opportunities. CMC Markets has an overall rating of 3.7 out of 5, based on over 192 reviews left anonymously by employees. 68% of employees would recommend working at CMC Markets to a friend and 69% have a positive outlook for the business. This rating has improved by 3% over the last 12 months. An excellent trading platform, quick and easy to use with helpful information. Leveraging occurs when you use borrowed funds to invest.

We do this solely for the purpose of helping the general public make the better decision. While it was not immune to the supply chain problems, the company noted that the vast majority of its product range is sourced domestically on lead times, with boss Peter Pritchard declaring “our business has never been more robust”. Some investors may indeed look past the financial metrics and KPIs to instead focus on outlook and strategy. Indeed, the easing of Covid lockdowns saw most stocks do well in recent months but things proved stickier for trading firms like CMC – as last year they saw a ‘trade from home’ boom boost customer numbers and account activity. How we protect investors and ensure the integrity of markets in Canada.

Read employee reviews and ratings on Glassdoor to decide if CMC Markets is right for you. The following pointers highlight common trading mistakes and show how you can avoid these by building a trading evaluation strategy. Very good platform for a beginner and for not so beginners. Among others I value the high quality of the application, both web and mobile, and the low spread.

For example, underlying equity securities must be listed or quoted on certain “recognized exchanges” such as the Toronto Stock Exchange or the New York Stock Exchange. Most brokers offer multiple platforms tailored to different experience levels. The basic trading platforms feature low minimum cmc markets review account requirements, while advanced platforms will offer reduced pricing for higher volume, active traders. As an FSA-regulated firm, the Filer is required to comply with certain rules of the FSA . The FSA Rules seek to ensure that regulated firms satisfy certain minimum business standards.

IB Canada customers benefit from seamless connections to more than 100 equity and derivatives exchanges and a growing number of Electronic Communication Networks . CMC UK is regulated by the FCA which has a robust compliance regime including specific requirements to address market, capital and operational risks. CMC Canada is regulated by IIROC, which has a robust compliance regime including specific requirements to address market, capital and operational risks.

Find out how long term investments work and how to use long term investments to build your wealth. Yes, the CMC Markets Trading app makes it possible to place trades from your iPad, iPhone or Android device. $0 commission on all transactions for Finder investors.

Additionally, to its headquarters, CMC Markets also has numerous other locations, including Canada, Australia and Japan. With CFD trading, the broker provides its customers with over 6,000 different base values. The trading platform is called “NextGeneration” and was developed by the broker himself. In a forward forex market, contracts are made between two parties to buy a foreign currency for a specific price on a future date. The currency itself is not being traded; rather, it’s the right to buy the currency.

The degree of leverage may be amended in accordance with the IIROC Rules and the IIROC Acceptable Practices as may be established from time to time. The Filers have at all times since the Existing Relief lapsed acted in full compliance with the terms and conditions set out in such relief, except for the four-year sunset clause. An ‘exploratory review’ was launched in December over a possible break up to unlock shareholder value, with CMC’s retail derivatives – or ‘leveraged’ operations potentially being split from its investment platform and business-to-business operations. We therefore recommend not only to look at the overall rating, but also to read through the ratings intimately.

The Filer has established a Canadian dealer affiliate, CMC Markets Canada Inc. , to act as a dealer for CFDs issued by the Filer to Canadian investors. The ultimate parent company of CMC Canada is CMC Markets Plc and is therefore an affiliate of the Filer. CMC Canada is a corporation amalgamated under the laws of Canada with its principal office in Toronto, Ontario. The Filer is not currently a reporting issuer in any Jurisdiction. Such acknowledgement is separate and prominent from other acknowledgements provided by the client as part of the account opening process. The IIROC Rules and the IIROC Acceptable Practices set out detailed requirements and expectations relating to leverage and margin for offerings of CFDs.

Taking a quick screenshot of the chart when you placed your trade takes just a couple of clicks. All of this information will be very useful when you finally sit down to review what you have done and will help you see if there is any way of improving your future strategies. I’ve been trading with CMC markets for many years, they have a very good platform with all necessary tools for technical analysis, as well as tools/news for fundamentals, they are a trustworthy, helpful site for traders starters and veterans alike. When it comes to forex, Interactive Brokers offers over 100 currency pairs across 23 currencies, sophisticated FX trading tools like real-time quotes, and up and down indicators. Below is a list of four top Canadian forex brokers.

The more advanced FlightDesk platform comes in standard and premium versions with tools for more technical analysis as well as one-click order entries, bid and ask trend indicators, real-time trade notifications, and options chain trading. Though their fees and account minimums are slightly on the higher side with discounts for high volume traders, they provide a full suite of tools to help you invest. Scotia iTRADE also offers a mobile trading app for iOS and Android users.

Boeing shares were up about 6.5% at $152.84 in afternoon trade. Investors have been skeptical of Boeing’s targets due to production delays, cuts in the jet delivery outlook and mounting losses at its defense business. Last month, as part of its regular survey of dealers before each of its quarterly refunding announcements, the Treasury asked dealers about the specifics of how buybacks could work. These included questions on how much it would need to buy so-called off-the-run https://broker-review.org/ Treasuries, which are older and less liquid issues, to improve liquidity in those securities. On Wednesday, it said it had not yet made any decision but that it would continue to meet with a variety of market participants to assess the costs and benefits of buybacks. The Filer and its affiliates have offices that offer CFDs in 12 countries including the United Kingdom, Australia, Austria, Canada, China, Germany, Hong Kong, Ireland, Japan, New Zealand, Sweden and Singapore .

Leave a Reply